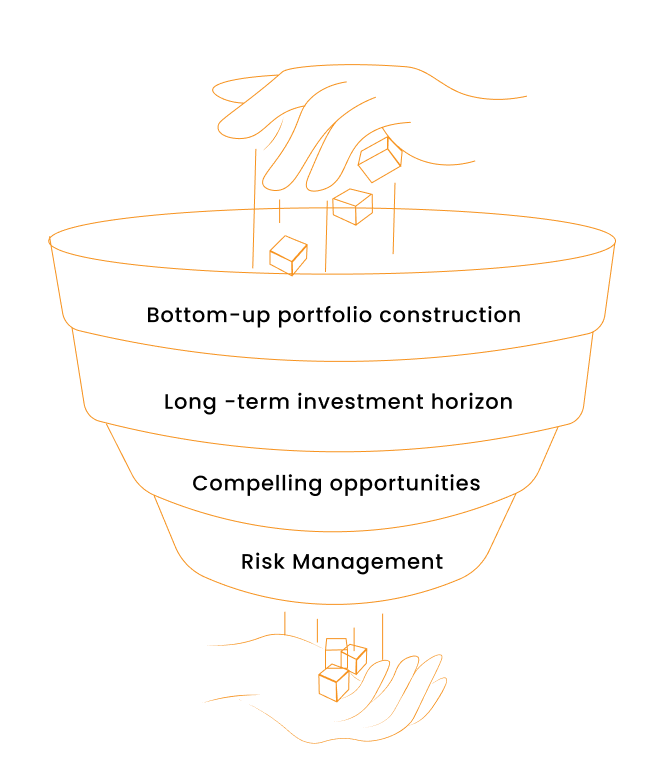

- Bottom-up portfolio construction

We build the portfolio completely from the bottom up, not based on any Index. Because of this, our portfolio’s overlap with indices tends to be very low and sector exposures tend to be very different from the Index.

- Long -term investment horizon

We are patient, long-term investors. We seek to take advantage of significant stock price declines due to poor near-term business results, focusing instead on the long-term intrinsic value of the business.

We are not afraid to hold cash

at times when underlying valuations are elevated. This provides us with the ability to act quickly when market sentiment swings to the other extreme and short-term market disruptions provide compelling opportunities from panicked sellers.

We limit exposure to a specific sector / stock to a certain level to manage risk . While this may lead to lower returns, it allows us to manage the portfolio risk within acceptable level.